Vietnam pepper monthly round-up April 2022

The Ministry of Agriculture and Rural Development stated that fertilizer prices have increased to the highest level in the past 50 years.

Market

According to International Pepper Community (IPC), the high USD exchange rate is negatively affecting world pepper prices in particular and commodities in general.

In additional, the recent price drop in April has led to an overabundance of pepper stock in the market.

Export

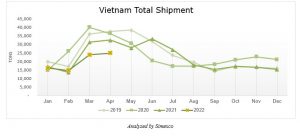

As in latest report from Vietnam Pepper Association, in April 2022, Vietnam has exported nearly 24,795 tons pepper of all kinds. Compared to March, export volume increased by 3.5%.

Statistics of VPA show that in April 2022, Vietnam export volume includes 21,337 tons of black pepper (up 8.6% Month over month (MoM)) and 3,458 tons of white pepper (down 16.5% MoM) while others take up to 152 tons. Total export turnover reached over 115,2 million USD (up 1,9% MoM), black pepper reached 93.43 million USD, white pepper reached 21.03 million USD, the rest accounts for 0.74 million USD. Compared to the same period of 2021, accumulated export volume of 2022 decreased by 15.5% while the export value increased by 29.2%.

In the latest update, the US continues to be the largest pepper import market of Vietnam, reaching 5,156 tons (down 5.6% MoM), accounting for 22% of total Vietnam export volume; followed by India, The United Arab Emirates, Germany and Korea.

March and April are usually peak export months of a season but the statistic is not as good as expected in 2022. This could be explained by the lock-down in China, which raised the cost of transportation and lower the demand for pepper. Another factor to be a cause is the Russia-Ukraine conflict. The entire Eastern Europe is suffering with vessels stranded, supply chain disrupted and more.

Logistics

News from Sea Intelligence reveals that congestion has eased at many regional ports in China. Meanwhile, Shanghai is still under lockdown due to the Covid-19 outbreak in major manufacturing areas here. The number of ships waiting to dock in Shanghai has been reduced temporarily. However, a return to congestion is expected when Shanghai is able to return to production and shipping.

The current balance leaves more room for shipping demand on the transpacific route than there has been for most of the past two years, as China exporters were known to take up almost spaces on vessels.

Importers and retailers in the US tried to replenish their inventory ahead of the annual peak season.

In addition, April is affected by the extended Labour Day holidays.

Inventory

By the end of April, basically Vietnamese pepper farmers have finished harvesting. Worldwide market became quiet due to factors such as war in Eastern Europe, China’s closure against zero covid policy, increasing inflation, etc. Therefore Vietnam’s inventory at this time is still abundant, even though it is estimated that the 2022 crop will reduce output by 10% compared to the previous one.

Sustainable

In Pepper growing area, after harvesting, the pepper plants show signs of weakness. Farmers are carrying out cleaning and restoration activities.

As May is the time of fertilizer for the new crop of 2023 before the rainy season, but pepper growers are having a headache with the current situation of fertilizer prices. The main source of matter comes from Russo-Ukrainian war, which continuously affects fertilizer prices. The Ministry of Agriculture and Rural Development stated that fertilizer prices have increased the highest in the past 50 years.

In the raw material areas in Krong Nang, farmers intercrop fruit trees such as Macca, Durian into the pepper garden to increase their income.