Vietnam pepper monthly round-up August 2021

Inventory

According to Simexco’s data, in the past 8 months, total consumption included export and domestic has reached 73% of total supply.

With current inventory of 75,550 tons, famers account for about 24.5%, exporter: 26.5%, collector 20% and speculator 29%

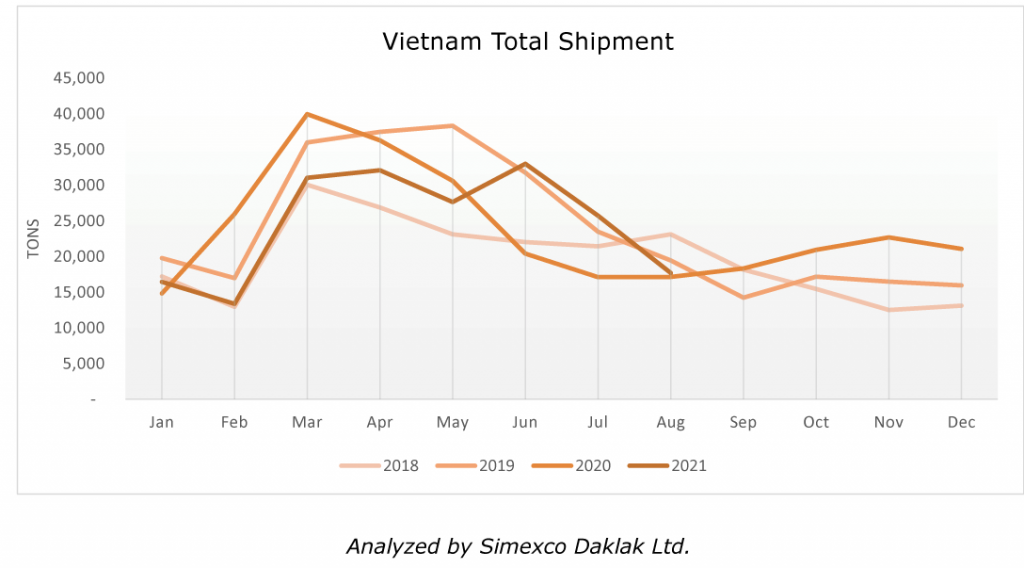

Shipment

According to the General Department of Vietnam Customs, in August 2021, Vietnam exported 17,700 tons, meet 197,700 tons by the end of month.

Demand in the US and European markets is also increasing as these countries are loosening social distancing.

According to VPA data, the US market is the largest pepper importer of Vietnam, accounting for 22% of the export volume of this item. Europe ranked second, followed by China accounting for 13%.

MARKET FORCAST:

The Commercial Chamber of Vietnam forecasts the world pepper price will be supported due to a temporary supply shortage from Vietnam.

High sea freight and the shortage of empty containers cause severe stagnate in Vietnam Ports.

Meanwhile, the raising fear of exposing to carriers during Covid- 19 pandemic has caused huge amount of local suppliers to stop providing peppers to the market.

Price

The price of raw material keeps increasing from 75,000 – 78,000 VND/kg in Daklak and 77,000 – 80,000 in Dong Nai, Binh Duong, … during August 2021. The situation of continuous rising sea freight, and tightening supply from suppliers and farmers has a strong impact on the price of raw materials. Vietnam pepper in the coming time will be quite favorable due to increased demand from partners, especially China and it is said to remain stable at high levels in Q3 thanks to support factors such as reduced output, complicated COVID-19 epidemic, sea transportation crisis, etc.

Supply

In August, the Covid epidemic continued to affect the Vietnamese pepper market. Due to directive 16, suppliers in southern of Vietnam such as Dong Nai, Ho Chi Minh, Binh Duong were still inactive.

Besides, all other activities are suspended and traffic is temporarily frozen due to the travel restrictions of Directive 16, suppliers and farmers cannot sell their good.

It is said that new cropsize can be lower in comparision to crop 2021. Many large importers have been considering to buy goods to meet the high demand of the market in end year season.

Weather

After a period of dry weather in June and July 2021, we have seen rain in August across pepper growing regions. Good rains have been recorded across the Central Highlands provinces over the last month, with most of the key regions recording more than 200 mm of total rainfall. However, the total rainfall recorded is still lower compared to previous years and 4 years average. This may have negative impact upon the next crop production.

Others

Vietnam’s Prime Minister recently tightened pandemic restrictions in Ho Chi Minh City and other neighboring provinces included Daklak that require people not to leave their houses. This will slow down the harvest process. The cost for pepper production has increased sharply such as fertilizer with an increase of 70% – 80%, gasoline with an increase 13,63% compared to the same period last year, labor costs increased due to pandemic restrictions…

Also, Restrictions have affected both the traffic of people and cargo. Supply chain disruption caused by labor shotage, port congestion, shortage of empty containers and high sea freight could reduce pepper exports.

Disclaimer

This publication has been prepared by web đánh bài Ltd., for information purposes only and are not intended (and should not be considered) to be legal advice on any subject matter. web đánh bài Ltd., does not give any representation or warranty, whether express or implied, as to the accuracy, completeness, currency or fitness for any purpose or use of any information in this publication or as to whether this publication reflects the current legislative or regulatory position or any other relevant developments. web đánh bài Ltd., assumes no responsibility to update this publication based on events after publication of the information contained therein.

Readers are responsible for assessing the relevance and accuracy of the content of the information in this publication. web đánh bài Ltd., will not be liable for any loss, damage, cost or expense incurred or arising by reason of any person using or relying on information therein.

Information in this publication should not be considered as advice, or as a recommendation or solicitation to purchase or otherwise deal in securities, investments or any other products. Such information has been prepared for institutional clients, is not directed at retail customers and does not take into account particular investment objectives, risk appetites, financial situations or needs. Recipients of the document should make their own trading or investment decisions based upon their own financial objectives and financial resources.

For further information concerning the contents and usage of this publication pls contact: [email protected]